A Complete Guide to Cremation Insurance

Cremation insurance is a type of final expense life insurance specifically earmarked to cover the costs of cremation and other final wishes. In the past, cremation has cost less than traditional burial, but with more people choosing to be cremated every year, funeral homes have started adjusting their prices. Today, the cost of cremation can rival the cost of a traditional burial depending on the options chosen, the facility used, and whether or not the funeral home is used for a service beforehand. Purchasing cremation insurance today can help cover the costs of your final arrangements, so you can avoid burdening your loved ones with expenses when you’re gone.

Table of Contents

How to Find the Best Cremation Insurance Policy

If you’ve decided that cremation is the best choice, you’ll want to research the best way to pay for it once you pass. Think of a cremation insurance plan as a small life insurance policy that covers your end-of-life expenses. The end result is a tax-free cash payout that your beneficiaries can use to carry out your final wishes.

Many people choose to set aside additional funds to enable their beneficiaries to cover a variety of other end-of-life expenses. When you’re looking into cremation insurance, here are some factors you might consider when deciding how much coverage to take out:

- Outstanding debts: You can add additional funds to cover your remaining debts such as mortgage payments or unpaid medical bills.

- Income replacement: If your loved ones would experience a loss of income, consider supplementing your cremation plan with additional coverage or a separate life insurance plan like term insurance. Cremation insurance typically pays the death benefit faster than other types of life insurance, making it ideal to cover final arrangements. Once those are taken care of, a term policy can help your family as they adjust to living without your income.

- Time off work for surviving loved ones: If your beneficiaries need to take work leave after your passing, your policy can help them afford the time off.

- Travel costs: Some people add in extra funds to cover the costs of attendees at the funeral, from air travel to hotel stays.

- Legacy: You can also use your policy to leave behind additional funds for your beneficiaries to spend as they please or leave behind a charitable donation.

As you determine how much insurance you need, it’s important to account for inflation. The price of virtually everything increases over time – funeral costs included – so be sure your policy will cover your arrangements if you purchase it many years before you pass. But above all, be honest with yourself about how much you can afford. Taking out a small cremation policy can make a world of difference to your loved ones when the time comes.

Comparing Plans

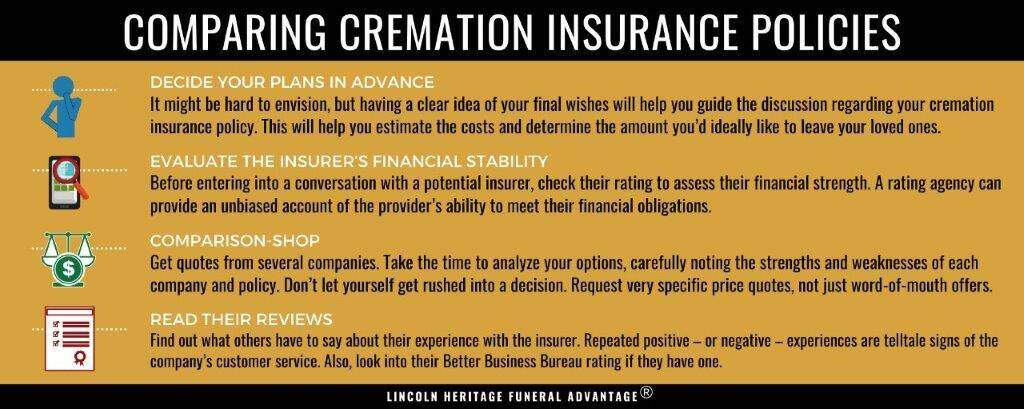

The most important thing is to shop around. There are hundreds of companies offering cremation insurance, so unless you are a loyal customer of a specific insurer, don’t simply accept the first deal offered to you. Here are a few tips for finding the policy that is best for you and your family.

- Decide your plans in advance: It might be hard to envision but having a clear idea of your final wishes will help you guide the discussion regarding your cremation insurance policy. This will help you estimate the costs and determine the amount you would ideally like to leave your loved ones. It will also help as you price-shop with various insurers since they may try and sell you a policy you don’t want or need.

- Evaluate the insurer’s financial stability: Before entering a conversation with a potential insurer, check their rating to assess their financial strength. A rating agency can provide an unbiased account of the provider’s ability to meet their financial obligations.

- Comparison-shop: Get quotes from several companies. Take the time to analyze your options, carefully noting the strengths and weaknesses of each company and policy. Don’t let yourself get rushed into a decision. Request very specific price quotes, not just word-of-mouth offers.

- Read their reviews: Find out what others have to say about their experience with the insurer. Repeated positive – or negative – experiences are telltale signs of the company’s customer service. Also, look into their Better Business Bureau rating if they have one.

Cremation Insurance by AARP for Seniors

Unlike other providers, the American Associate for Retired Persons (AARP) is not an insurance company, but it offers strong cremation insurance policies through New York Life. As long as you meet their eligibility requirements, it is unlikely that you’d be turned down. The policy is available to AARP members age 50-74 and spouses age 45-74.

Funeral Advantage by Lincoln Heritage

Lincoln Heritage has been helping families save on cremation costs for over 55 years. Every Funeral Advantage plan comes with a dedicated representative from the Funeral Consumer Guardian Society® (FCGS) — at no additional cost. They price-shop cremation services, review contracts, and help surviving family members save hundreds — even thousands — of dollars on funeral and cremation costs. The policy is available to everyone until the age of 85. There are no medical exams required to qualify – just health questions on a one-page application.

How Does Pre-Paid Cremation Insurance Work?

If you’re considering paying for your cremation in advance, a pre-paid plan can help save money compared with paying at the time of need. Some options include:

- Paying for cremation in full upfront, often at a significant cost savings (often in a lump sum to a specific funeral home). This is typically called pre-need insurance and gives the policyholder less flexibility than final expense insurance.

- Paying for cremation over time, through installment payments that allow you to budget for the procedure.

A cremation insurance policy should allow you to choose how much coverage you would like. You should have the option to buy small amounts of protection, if you only need a little bit of coverage to pay for the cremation costs, or larger policies that will leave extra money for your beneficiaries to pay off your mortgage or medical bills.

How to Pay for Cremation Without Insurance

There are a few ways to find help paying for cremation if you can’t afford it or choose not to purchase cremation insurance.

Pre-paying for your arrangements does not require an insurance policy. You work directly with your chosen funeral home or crematory to pay for all their services. You typically have the option to pay a lump sum or installments.

Check with your local affiliations or employer. For example, unions and other work-sponsored groups often provide cremation and funeral assistance. Your employer-sponsored benefits package might also allow you to sign up for extra death benefits that cover the costs of your final arrangements.

You may be able to have your body donated to a university or private organization for medical research and educational purposes. Once the studies are complete, the body is typically cremated and the remains given back to the loved ones.

SAVE MONEY ON CREMATION COSTS

Frequently Asked Questions

Can you pre-pay for a cremation before you die?

Yes. You can arrange a contract directly with a funeral home or crematory to pay today for the procedure, and they will be contractually obligated to do so when you pass. The benefit is that this allows you to lock in current rates to avoid inflation or other cost increases. The down side is that you are then usually tied to that specific facility, unless your contract is portable or transferable to other facilities. Plus, all the money goes directly to the funeral home rather than your beneficiaries. Before choosing this type of contract, look into the benefits of using burial insurance.

How much does it cost to be cremated?

Cremation services themselves run approximately $3,000 - $6,000. These rates do not include the price of a funeral or memorial service, an urn, a burial plot, or any other arrangements you’d like. In total, it’s not unheard of to see a final price tag exceeding $10,000 for cremation. See here for additional helpful information on the costs of cremation.

Does burial cover cremation?

No. These are separate procedures with their own costs. And the prices are all dependent on a number of variables such as the city or state and the options selected to memorialize the deceased. Compare cremations and burials here.

Is it smart to pre-pay your funeral?

There are multiple benefits to pre-paying for your final arrangements. For one, it may end up costing less because you won’t have to worry about inflation because your services are paid in full (pre-need insurance). For another, this takes the financial burden off your loved ones during their time of grieving. Also, it ensures that your final wishes will be followed because all the arrangements will have already been made. Pre-paying with final expense insurance gives your family maximum flexibility, allowing them to price-shop cremation services and designate exactly how much of the benefit is spent.

Who has rights to ashes after cremation?

This has long been up for dispute, and it varies state by state. Typically, next-of-kin go in this order: 1. spouse; 2. adult children; 3. parents; 4. adult siblings. About half the states permit a person to name a designated agent for body disposition. Many states honor the written wishes of the deceased in a will regarding the final “owner” of their remains.

How do you arrange for a cremation?

You typically have two options: work with a funeral home or deal directly with a crematory. If you work with a funeral home, the funeral director will help you gather the necessary documentation for a death certificate and cremation approval paperwork, arrange for transportation of your body to the cremation facility, and carry out the disposition according to your wishes. For those handling it directly with a crematory, all the steps are basically on a do-it-yourself basis.

Will the state pay for cremation?

Only a few states offer financial assistance for cremation and other funeral costs, typically in the form of grants or low-cost loans. The children of the deceased can usually receive assistance if they can’t afford to pay for the service. Contact your local Department of Human Services to find out what options are available. Counties and local governments may offer programs to qualified low-income residents, and the Social Security Administration may also provide limited financial assistance.