Complete Guide to Prepaid Funerals: Plan, Costs, Pros & Cons

Setting aside money to take care of any large expected expense is a smart thing to do, and a funeral is no different. The key is to understand how pre-paid funeral plans work.

More and more people are pre-planning their funerals to save loved ones the stress of having to do it during such an emotional time. And when you make your own arrangements, it can also save money because you can specify which type of service you want.

But not all pre-paid funeral plans make sense financially. Let’s take a look at what works, what doesn’t, and what questions you need to ask to ensure you find the right plan for you.

Want to learn more? These guides can help:

What are Prepaid Funeral Plans?

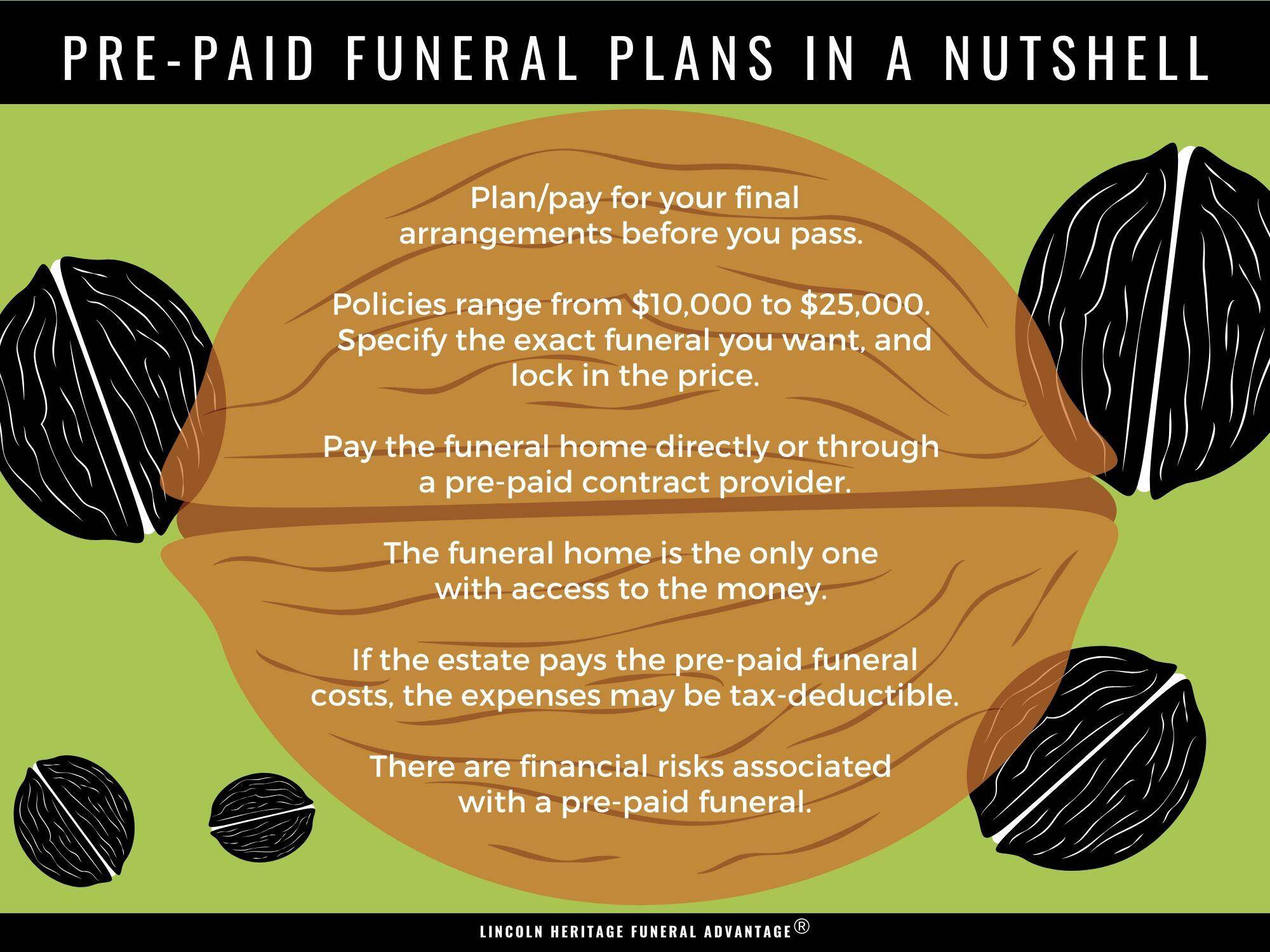

A pre-paid funeral is a plan made with a funeral home that’s been paid ahead of time (the money has already been paid or has been set aside for this purpose). There are different ways to do this, depending on your preferences and financial concerns. The plans typically range from $10,000 to $25,000 policy amounts, and are paid for in monthly installments directly to the funeral home.

Pre-paid funeral plans provide a way for people to pay for their funeral arrangements before they pass. It’s for people who want to spare their loved ones from having to make decisions and experience financial stress while grieving. But some experts say these types of plans may end up costing you more than you would pay for an average funeral after fees and other charges have been calculated.

Prepaid Funeral Plan Costs & Expenses

Most pre-paid insurance policies range from $10,000 to $25,000. When buying one, you can pay the entire amount up front, or you can arrange to make payments with a three, five, or 10 year plan. In addition to the cost of the funeral, you should expect to pay some other fees. For instance, you may pay administration setup fees of $100 to $200. And some plans charge $50 to $150 ongoing and yearly maintenance fees.

Are Prepaid Funeral Expenses Tax Deductible?

A lot of people wonder, “Are funeral expenses tax deductible?” It’s a good question. While most funeral expenses are not tax deductible for individuals, the rules change when the estate pays for the burial costs. The IRS says that if the estate pays the funeral costs, such as when using pre-paid plan, the estate can use the expenses against its taxes as a deduction. Always consult a tax professional before assuming something is tax deductible.

Should You Prepay Funeral Expenses?

In fact, state and federal authorities have investigated funeral homes and pre-payment providers and have found alarming violations of trust because these plans don’t have a lot of regulatory oversight. If a funeral home isn’t reputable, they can misspend or embezzle your funds. Some even go out of business before the need for the pre-paid funeral arises. Others sell policies that are virtually worthless. Federal authorities passed the Funeral Rule in 1984 that provides some consumer protection, but state laws vary and some states offer less protection than others.

An alternative to pre-paying for your funeral expenses is to take out a small, final expense life insurance policy. These policies are highly regulated by numerous state and federal authorities and offer more flexibility than pre-paid funeral plans.

What Expenses Does a Prepaid Funeral Plan Typically Cover?

A prepaid funeral plan is customized to include the services and goods you want for your funeral. For instance, you can include the funeral home services, the casket, flowers, transportation, and anything else you require.

After you’ve made a list of everything you want to include in the policy, the funeral home director will arrive at a price, and that will be the basis for your policy.

When buying a prepaid funeral plan, you can choose a guaranteed plan that specifies the exact goods and services you want, and the price you agree to is locked in. That means even if prices go up, your loved ones won’t have to pay more. Nonguaranteed plans don’t offer this protection. That means if you choose a casket that costs $3,000, and by the time you pass, the least expensive caskets are $6,000, your loved ones will have to pay the additional $3,000.

How to Prepay

When paying for a prepaid funeral plan, you can either work with the funeral home directly or with a prepaid contract provider. These providers work with multiple funeral homes and arrange for the plan payments. After you select the goods and services you want, you will set up a payment plan with the funeral home or provider.

Pros & Cons of Prepaid Funeral Plans

When thinking about purchasing a pre-paid funeral plan, it’s smart to look at all of the pros and cons of using one:

| Pros | Cons |

| You can gain peace of mind by taking care of the details of your funeral so your loved ones won’t have to after you’re gone. | The funeral home could go out of business, and that could leave your loved ones with the costs despite your efforts. Check with your funeral home to see what their process is. |

| You can arrange the type of funeral you want and choose the cemetery plot you want to lie in. | Most prepaid funeral plans don’t transfer – if you have a contract with one funeral home and die in another location or want to move, the funeral home often won’t transfer your plan to the new funeral home. |

| With a guaranteed plan, you can lock in today’s prices – even if prices go up. | You may not get a refund if you change your mind about the plan or decide to pay for your final expenses differently. |

| Some people have a funeral home they’re adamant about using. Purchasing a prepaid funeral home with said funeral home ensures their final wishes will be honored. | Prepaying your funeral expenses doesn’t leave any money for your family to pay for other end-of-life expenses you’ll incur, such as medical expenses. |

Funeral Insurance or Final Expense Insurance Policies

One way to pay for your funeral expenses in advance is to purchase a funeral insurance policy, also known as final expense insurance or burial insurance. When buying life insurance policies, you can assign a beneficiary to receive the death benefit, such as a family member, a friend, or anyone else who you trust. Unlike prepaid funeral plans, life insurance benefits can be used for a variety of things, including funeral costs. But the beneficiary can also use them for things like medical expenses, credit card debt, and any utility expenses incurred that month.

In some states, you can list a funeral home as your beneficiary. If a funeral home is your beneficiary, your family will have to rely on them handling the death benefit honestly and with integrity. Keep in mind that if you name a funeral home as your beneficiary, there may not be any funds left over for your family.

Average Funeral Costs

The National Funeral Directors Association (NFDA) conducted a survey to calculate the median cost of a funeral. In 2021, the median cost was $7,848 without a vault; including the vault increased the cost to $9,420. This does not include the burial plot, headstone, flowers or an obituary.

Here is the funeral cost checklist included in the median funeral expenses in 2021, according to the NFDA:

| Item | Cost |

| Funeral home’s basic service fee (nondeclinable) | $2300 |

| Transporting remains to funeral home | $350 |

| Embalming | $775 |

| Preparing the body in other ways, such as makeup and hair styling | $275 |

| Facilities and staff to manage a viewing | $450 |

| Facilities and staff to manage a funeral ceremony | $515 |

| Hearse | $350 |

| Service Car | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Median cost of funeral with viewing and burial | $7,848 |

| Vault | $1,572 |

| Cost with Vault | $9,420 |

Prepaid Funeral Plan vs. Funeral Insurance

Although it’s easy to assume that a pre-paid funeral plan and a funeral insurance policy are the same things, they’re not. A pre-paid policy is paid directly to the funeral home where you signed the contract. The funeral home is the only one that has access to the money. Depending on whether or not the plan is guaranteed or not, your family may have to pay additional costs.

On the other hand, a funeral insurance policy allows for more flexibility. You can assign any beneficiary you want, and they can use the payout for your funeral expenses, medical bills, final utility payments, and other outstanding bills. And if there is money left over, your beneficiary can do with it as they please.

| Funeral Insurance | Prepaid Funeral Plan |

| Extremely flexible – can be used anywhere in the world. | Extremely limited – can often only be used at the funeral home it was purchased from. |

| Additional benefits usually available in the form of policy riders. | Additional benefits aren’t usually offered. |

| Money is paid directly to the beneficiary. | Money is paid directly to the funeral home. |

| Families can price-shop funeral services to get the best deal. | Prices are set by the funeral home and no price-shopping is available. |

| Policy benefit can be split among multiple individuals or organizations. | Policy benefit is for the funeral home only. |

| Typically builds cash value that can be withdrawn in the form of a policy loan. | May or may not build cash value. |

Prepaid Funeral Trust

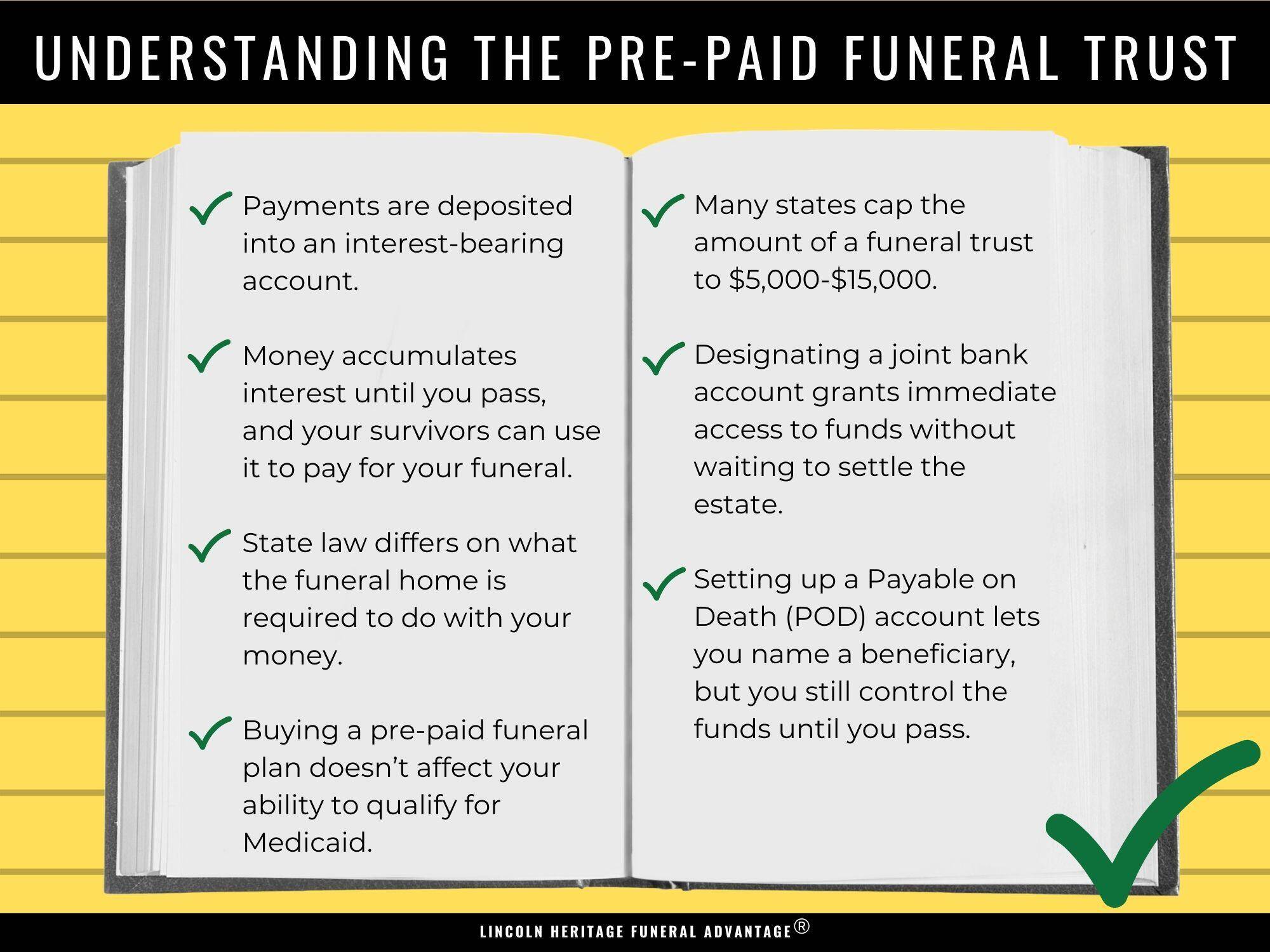

If you decide to work directly with the funeral home, they may offer you a trust-based pre-payment plan where your payments are deposited into an interest-bearing account. The money accumulates interest until you die, and then your survivors can use it to pay for your funeral.

But depending on which state you live in, the funeral home is only required to put up to 60 percent of the payments into the account. What’s more, they are allowed to keep 10 percent or more for administrative fees, and they can lock the trust and use the money to pay their administrative fees if you miss payments. And if you decide to cash out the trust? Some states allow the funeral home to keep up to 30 percent of your money.

Irrevocable vs. Revocable Trusts

When signing a contract with a funeral home, you can sign an irrevocable trust or a revocable trust. If you sign an irrevocable trust, the contract is permanent and cannot be changed. In other words, you won’t be able to change your mind and get a refund. To qualify for a Medicaid exclusion, you have to sign an irrevocable trust.

On the other hand, if you sign a revocable trust, you have the right to change your mind and receive a refund.

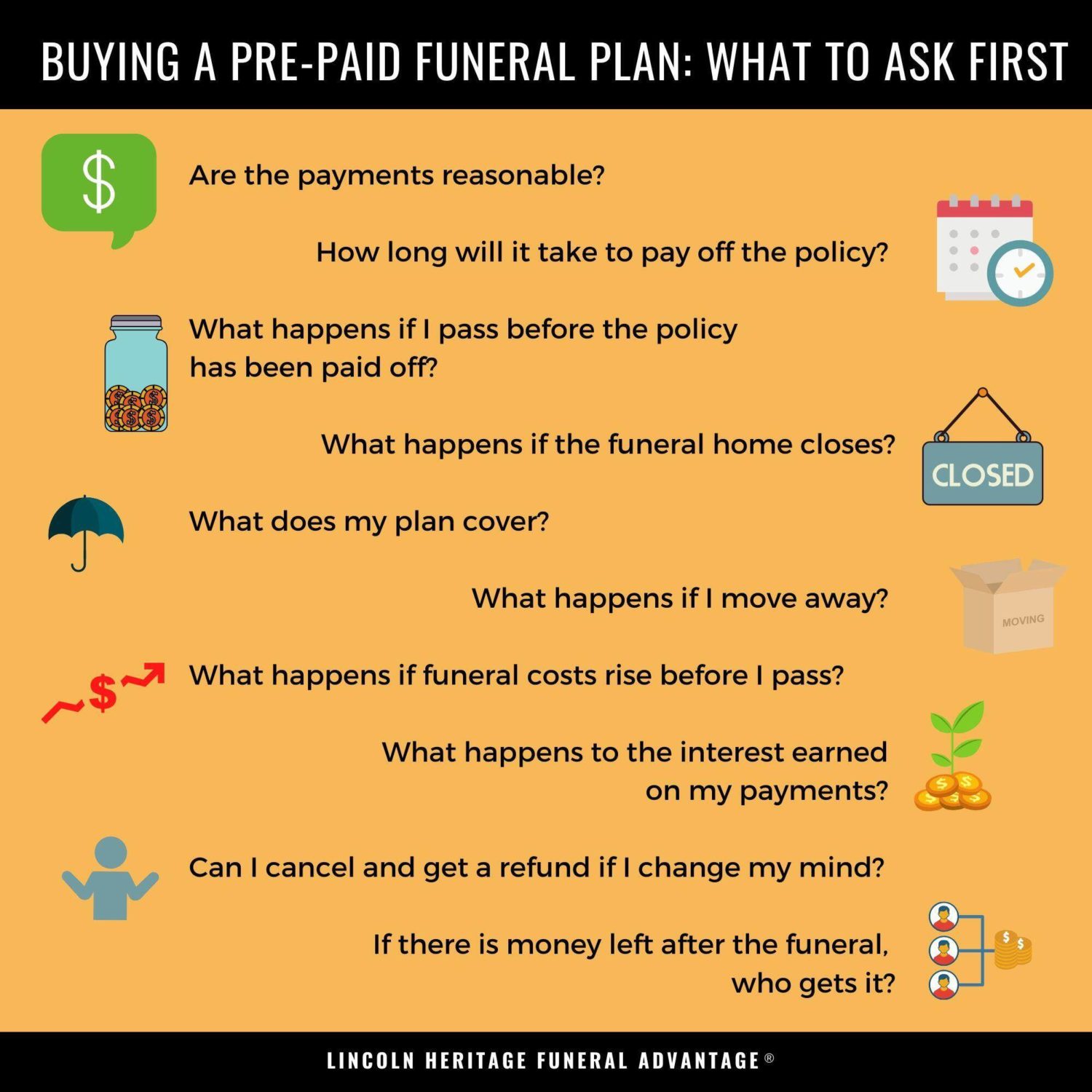

Questions to Consider Before Prepaying

Before buying a prepaid plan, ask the following questions.

- Are the payments themselves reasonable?

- How long does the policy take to pay off? What happens if the person dies before the policy has been paid off?

- What happens if the funeral home closes or changes ownership?

- What are the consumer protection laws in your state?

- What exactly does the money you pay cover?

- What happens if you move away?

- What happens if funeral costs rise before you die?

- What happens to the interest earned on the payments you make?

- Can you cancel the contract and have your money refunded if you change your mind?

- If there is money left after the funeral, who gets it?

Prepaid Funerals & Medicaid

When you buy a pre-paid funeral plan, it is excludable for the Medicaid spend down process. That means it won’t affect your ability to qualify for Medicaid. But keep in mind that many states limit the amount you can put in a funeral trust to $5,000 to $15,000.

Common Prepaid Funeral Arrangements & Services

Not all prepaid funeral insurance plans are the same, and you can ask to include anything you want in yours. But keep in mind that the policy amount is affected by what you include. Most preset plans include:

- Funeral home expenses

- The death certificate

- Clergy expenses

- The cost of the burial

Some prepaid funeral home plans don’t include the casket, headstone, or cemetery plot. Keep in mind that, in most instances, you can customize your plan by working directly with a funeral home.

Designating a Joint Bank Account

When a person dies, his or her assets can be temporarily unavailable – even to a family member – until they settle the estate. Setting up a joint account solves this problem because the survivor on the account has immediate access to the funds. This option is useful only if there is enough money in the account to pay for funeral expenses. If the act of continually making deposits and leaving the balance alone seems difficult to you, another option might be better.

Setting up a Payable on Death Account

Also called Totten Trusts (the name comes from a 1904 New York court decision), a Payable on Death (POD) account is set up through your bank. With this type of account, you name a beneficiary, and the funds are available to that person when you die. Until that time, however, you are free to add or withdraw money, move or close the account, or change the beneficiary. A POD account avoids probate.

Using an Existing Life Insurance Policy

If you have a life insurance policy – either term life or whole life insurance – it is probable that the death benefit will be enough to cover your funeral expenses. (It’s important to tell the beneficiaries that using some of the money to pay for your funeral is your intention.)

However, term insurance could expire before a person dies, and some people choose not to renew, meaning there will be no death benefit. Learn more about how whole life insurance works.

Purchasing a Final Expense Policy

This kind of life insurance policy, also called burial insurance or funeral insurance, is purchased from an insurance company and covers not only funeral expenses but also any final medical expenses or other costs incurred near the end of life. Purchasing this type of policy usually requires answering a few health questions on an application. Typically, these plans include a death benefit ranging from $10,000 to $25,000.

Learn more:

Life Insurance for People Over 50

No Matter What Option You Choose, Family Communication is Critical

Either circumstance means that, despite your best attempt to help your loved ones get through a tough time, they will make arrangements and pay for them without knowing you’ve already taken care of the details. Regardless of how you choose to pre-pay for a funeral, be sure your family members know about the arrangements and have copies of all the important papers.

Learn more:

What to Do When a Loved One Dies

Can I Buy Life Insurance for My Parents?

Other FAQS

What if I want to leave my beneficiaries some money in addition to my funeral expenses?

If you purchase a pre-paid funeral plan at a funeral home, your beneficiaries won’t see any of the money. Instead, the funeral home will use it all for your funeral. If you want to leave cash that amounts to more than your funeral expenses, purchase final expense insurance instead.

What happens if my loved ones want to use a different funeral home?

In most cases – unless you signed a revocable contract – your family and friends will have to work with the funeral home where you signed the contract. They will rarely be able to transfer the funds. But if you purchase final expenses insurance, they won’t be tied to a specific funeral home; they can use anyone they choose.

Will my insurance policy expire?

As long as you pay your premiums, your insurance policy will remain in force. This is true for both prepaid funeral plans and final expense insurance policies.

How Funeral Advantage Can Help

Lincoln Heritage Life Insurance Company’s Funeral Advantage program includes both a life insurance cash benefit and access to family support through the Funeral Consumer Guardian Society (FCGS). The policy requires no medical exam, only a set of health questions. As part of the program, you fill out a two-page Funeral Plan form and return it to the FCGS. Upon your passing, the FCGS will notify the funeral home and provide the home – as well as a family member or friend – with the Funeral Plan.