What’s the Difference Between a Pre-Need Plan and Final Expense Insurance?

Luckily, there are many options available when it comes to planning your funeral in advance. We’ll cover the two main options: pre-need plans and final expense insurance. But first, let’s look at how much funerals can cost.

The average cost of funerals

The average funeral cost is more than many people think. The National Funeral Directors Association’s most recent estimate of the median cost of a funeral with cremation is about $5,150, and its median cost of a funeral with burial is about $9,135. Those numbers don’t consider things like burial plots, upgraded urns or caskets, published obituaries, headstones, or flowers. The total for a funeral can easily approach $10,000 or more, potentially leaving unprepared families with a huge financial burden.

Paying for a funeral

People pay for funeral expenses in different ways. Some might begin setting money aside regularly in a savings or low-risk investment account earmarked for this purpose. The problem with traditional saving is the tremendous amount of discipline required to consistently save and to leave the savings alone once it’s there.

Others who already have existing life insurance plans may choose to designate a certain amount of the death benefit toward funeral expenses. However, depending on your age, your life insurance may be a term policy that expires after a certain period of time. If you don’t have some form of permanent life insurance, you can easily find yourself unprepared if your existing insurance expires.

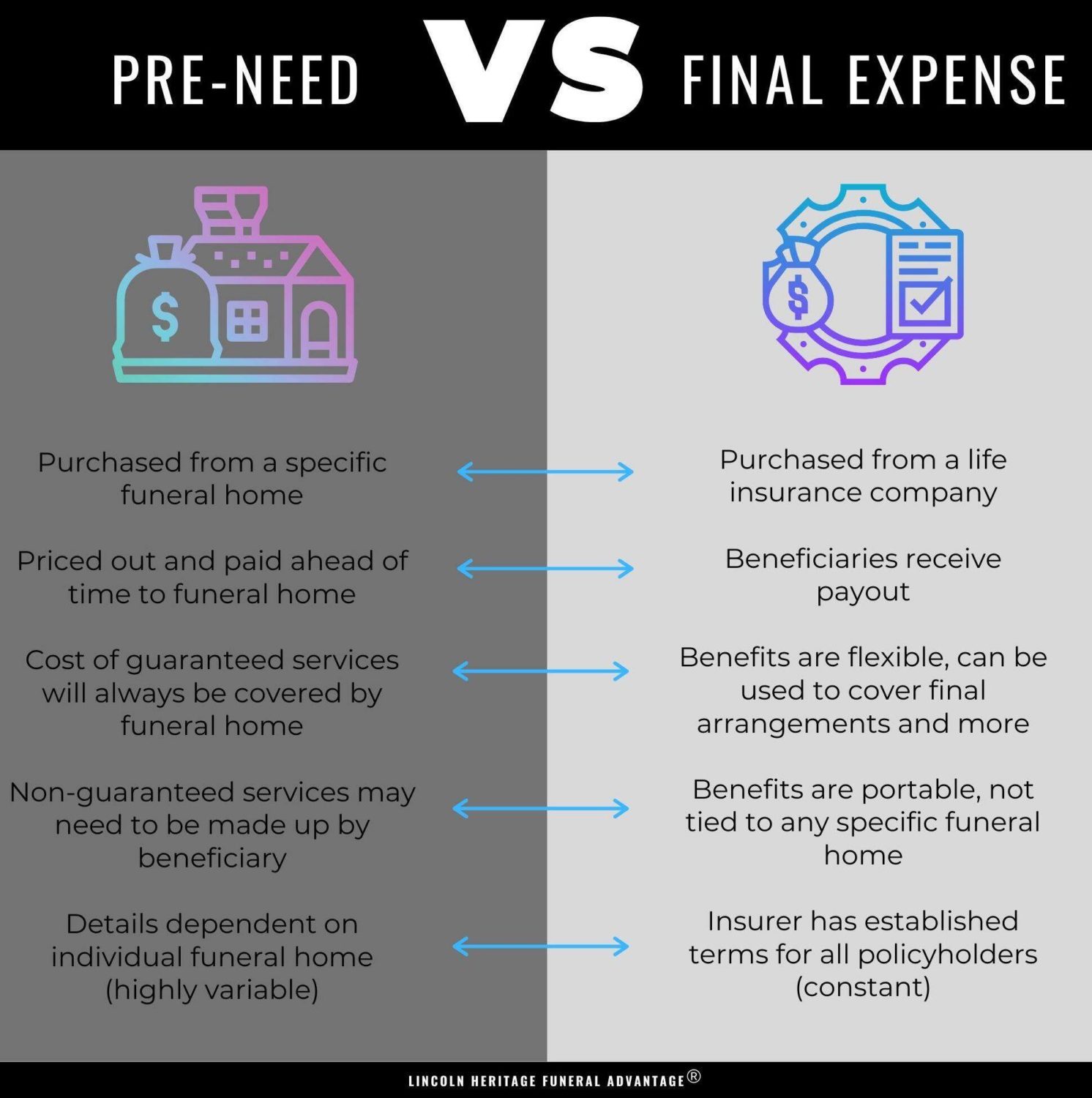

In your research, you may have encountered the terms “pre-need” (also called “prepaid”) funeral plans and “final expense insurance” policies. How do they work, and what are the differences between the two? Below are two basic explanations of the two.

Pre-need plans

A pre-need plan is purchased from a specific funeral home. To set it up, you choose the funeral home you want to work with and specify the arrangements you desire. The funeral home prices it out and you pay the cost ahead of time (either all at once or over time).

Final expense policies

A final expense policy is purchased from a life insurance company, and the beneficiary can be anyone of your choosing. The policies have death benefits that generally range from about $10,000-$25,000, and the money can be used for anything, including funeral costs, transportation of family members, or any unpaid medical expenses.

GET HELP WITH FUNERAL COSTS

What to know when considering a pre-need plan

Guaranteed services and non-guaranteed services

Should you be fortunate enough to live long after you set up your pre-need plan, the costs of your desired funeral may increase. Depending on whether these costs were guaranteed services or non-guaranteed services determines whether or not your family has to make up the difference.

For example, if a guaranteed service costs $2,000 now, but the cost rises to $3,000 by the time you die, your family does not have to make up the difference. The cost of guaranteed services will always be covered by the funeral home regardless of how much your plan is worth. Pre-need plans typically forecast this increase in costs and price their premiums accordingly.

If a service is not guaranteed, your family may be responsible for the difference in cost. Check with the pre-need provider to see how their plan handles non-guaranteed services.

Funeral homes determine the prices of their services

Because pre-need plans are purchased through funeral homes, your plan is designed to cover the specific costs that particular funeral home charges. But costs can vary from funeral home to funeral home. One funeral home may charge twice as much for the same service.

If you decide to purchase a pre-need plan, be sure and compare the General Price List (GPL) of several funeral homes before deciding who to purchase the plan from.

Questions to ask

Here are some questions the FTC encourages you to ask when considering prepaying for funeral services, according to its booklet, Shopping for Funeral Services:

- What exactly is included in the cost?

- Does the cost cover only merchandise, like a casket or urn, or does it include other funeral services?

- What happens to the money you have paid? State requirements differ in how the funds must be handled.

- What happens to any interest income?

- Are you protected if the funeral home goes out of business?

- Can you cancel the contract and get a full refund?

- What happens if you move or die while away from home?

FAQS: What to know about final expense insurance

Do final expense insurance policies offer flexibility?

With final expense life insurance, the benefit can be used for anything – it doesn’t have to cover funeral costs. If your beneficiary chooses to use the benefit to help cover funeral expenses, they don’t have to make the arrangements with any specific funeral home. The cash benefit from a final expense policy can be used anywhere.

Are final expense policies dependent on funeral homes?

Since your policy is not dependent on any particular funeral home, you needn’t worry about whether a certain funeral home gets sold or goes out of business. You also won’t be locked into any specific prices – you have the freedom to price shop the core services as well as any funeral items offered by the home such as headstones and caskets.

Are all final expense policies the same?

Not all policies are the same. Depending on what you want to protect, some final expense policies may be better for you than others. In general, most final expense insurance companies only provide a death benefit to your beneficiary. They don’t provide any assistance with handling the funeral arrangements or price shopping funeral items.

Because most people use final expense life insurance to help cover funeral costs, it’s important to make sure you choose a final expense provider that includes this as part of their policy. Choosing a final expense policy that will help your family navigate the funeral industry can help protect them from overspending on funeral arrangements.