A Complete Guide to Guaranteed Life Insurance

Table of Contents

Guaranteed Issue Life Insurance Policy: How It Works

The providers of guaranteed issue life insurance policies do exactly what the policy name implies: they accept everyone who applies. You can get one of these policies no matter what kind of health or financial situation you’re experiencing.

Graded Death Benefit

To reduce the risk, many insurers use a graded death benefit when issuing guaranteed issue life insurance policies. Not all insurers use a graded system, but if yours does, it’s important to understand how it works.

A graded death benefit changes the way an insurer pays the death benefit. If a natural death occurs during the first 2 to 3 years of a policy, the insurer will pay 110 percent to 120 percent of the premiums paid. In other words, they won’t pay the face amount of the policy but will reimburse the paid premiums, plus 10 to 20 percent. After the waiting period, the insurer will pay the full face amount of the policy if a natural death occurs.

Typically if the policyholder passes due to an accidental death (like a car accident) during the waiting period or any time afterward, the insurer will pay the full face amount of the policy.

GET A FREE BOOK & QUOTE TO SEE WHICH POLICY IS BEST FOR YOU

Pros vs. Cons of Guaranteed Issue Life Insurance

As with any life insurance policy, there are pros and cons to this type of policy. And it’s important to understand them so you can find the right life insurance policy for you and your family.

The main benefit to a guaranteed issue policy is that you can get coverage regardless of your health or financial situation and you will not have to undergo a medical exam or answer any medical questions.

But on the other hand, guaranteed issue life insurance policies are the most expensive kind of life insurance policy. Your policy may include a 2- to 3-year waiting period for death caused by natural causes. And the death payout amounts are typically smaller than traditional whole life policies.

| Pros | Cons |

|---|---|

| Your health and finances don’t impact your ability to get coverage | More expensive – usually 2-3 times the cost of traditional life insurance |

| Short approval process | 2- to 3-year waiting period |

| No medical exam or health questions | Small death payouts |

No Medical Exam, No Health Questions

When applying for traditional life insurance policies, you are required to undergo a medical exam or answer a few questions about your health. But with a guaranteed issue life insurance policy, you will never have to sit for a medical exam or answer any questions about your health.

Costs

Guaranteed issue life insurance policies are more expensive than other policies because the insurer is taking a risk by issuing a policy without understanding the insured’s health condition. In fact, the premiums can run substantially higher and because of the waiting period, you aren’t truly covered until the third or fourth year. In most cases, the cost is 2-3 times the cost of traditional life insurance.

Is Guaranteed Issue Life Insurance Worth It?

Guaranteed issue life insurance is worth it if you have no other options. Some people can’t qualify for traditional life insurance policies because of their health, and in these circumstances they may be willing to pay much higher premiums to leave their loved ones a payout after they’re gone. Keep in mind that most guaranteed insurance plans have a modified payout period. The full death benefit isn’t typically paid unless the policyholder lives past the graded period. If you have a terminal disease, it’s important to realize that if you pass before the graded period is over your loved ones only receive a refund of premiums paid, plus 10 to 20 percent.

If you can pass a medical exam, this type of policy is probably not right for you. That’s because the premiums are higher, and you will have a waiting period that doesn’t come with traditional policies. If you don’t want to pass a medical exam, but are willing to answers a few health questions, final expense life insurance may be the right policy for you.

Who Is Guaranteed Issue Life Insurance Typically For?

People who have serious medical conditions like cancer are good candidates for guaranteed issue life insurance policies. That’s because it can be very difficult to qualify for other policies with serious medical conditions such as this.

But that doesn’t mean guaranteed life insurance is your only option. For instance, you can buy burial insurance whole life policies without having to sit for a medical exam. Burial insurance can typically be issued by answering health questions on the application.

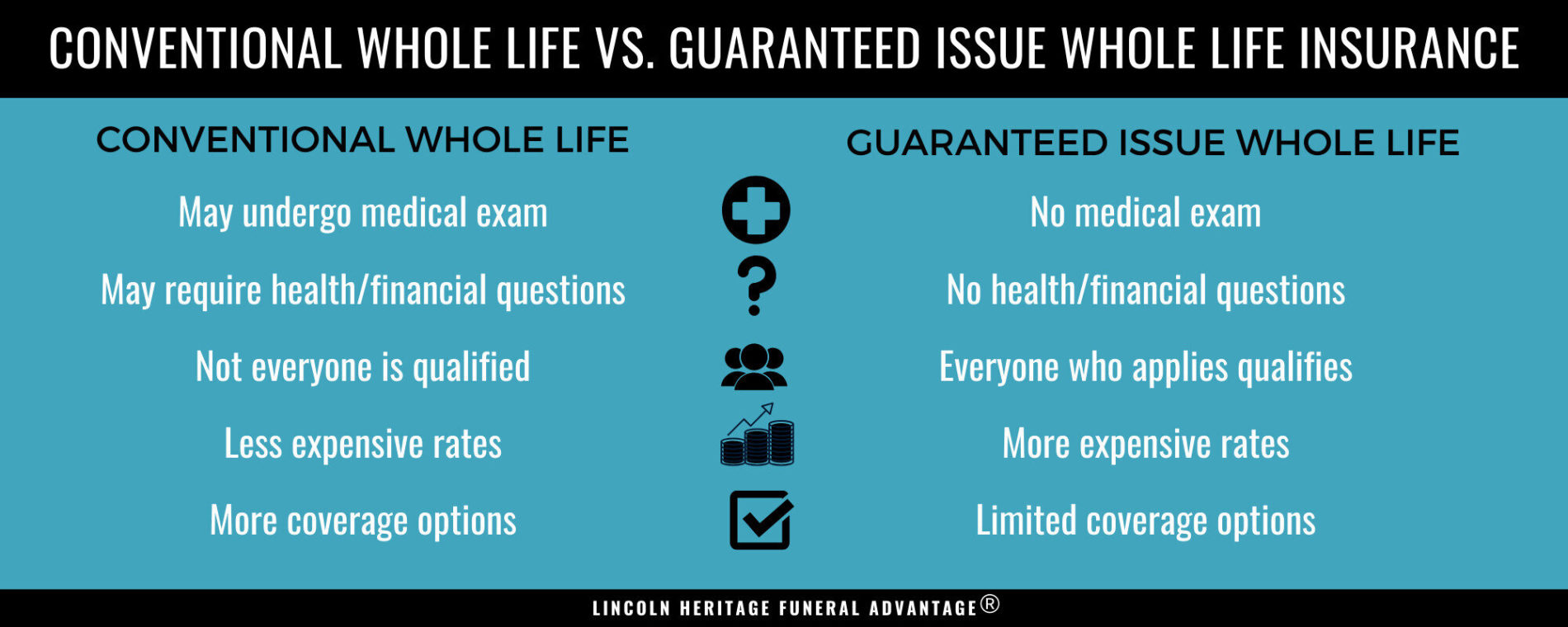

Difference Between Conventional Whole Life and Guaranteed Issue Whole Life Insurance

Traditional whole life insurance policies and guaranteed issue whole life insurance policies are quite different in how they approve applicants for a policy.

When applying for a conventional life insurance policy, you will have to sit for a medical exam or answer some questions related to your health. You will also have to undergo financial scrutiny. The insurer uses underwriters to examine your health and financial history to determine whether or not you are a good risk. If you are, the insurer will issue you a policy. But if you’re not, your application could be denied. If approved, the insurance company determines your premiums based on your age, sex, and health.

On the other hand, when you apply for a guaranteed issue whole life insurance policy, the insurer does not use underwriters. Instead, everyone who applies is automatically accepted. And your premiums won’t be based on your health. Instead, the insurer has premium guidelines that apply to everyone – regardless of health or finances.

Comparing Guaranteed Issue Whole Life vs. Guaranteed Issue Term Life

When choosing your insurance policy, you can choose between a whole life policy and a term policy. You can find both whole life and term insurance policies that are guaranteed and don’t require medical exams or answers to medical questions. But there are some major differences between the two.

Guaranteed Whole Life Insurance

Guaranteed issue whole life insurance policies are long-term policies that stay in effect as long as you pay the premium. You will not have to qualify for this type of policy by taking a medical exam or answering questions about your health. When you pass, the insurer will pay your loved ones a tax-free payout that they can use to pay for your final expenses or anything else they want to buy with the money. Whole life policies also accumulate cash value and can pay dividends.

Because there is no medical exam or health questions, you should expect to pay higher premiums for this type of whole life policy.

Guaranteed Term Life Insurance

A guaranteed issue term life insurance policy is only good for the term you agree to when you purchase the policy. For example, you can purchase a 10-, 20-, or 30-year term life policy. As long as you pay the premium for that time period, your life insurance policy is in effect.

But once the term ends, you no longer have insurance. Say you buy a 10-year term life insurance policy and pay the premiums for ten years. You will no longer have a valid insurance policy on the day after the 10-year term. And when you renew the policy, you will be 10 years older, which means your premiums will go up to reflect that.

You can also purchase a guaranteed issue term life insurance policy with no medical exam and without having to answer questions about your health. You can ask about buying a renewable term policy, which means you can renew you can continue to renew your policy without having to take a medical exam.

Some people think about term life insurance for aging parents, but that may not be the best option if the parent outlives the term life insurance policy. When buying life insurance for parents, consider all of your options.

Pros and Cons

As with other insurance policies, you need to evaluate the pros and cons to determine if guaranteed issue whole life insurance or guaranteed issue term life insurance makes sense for you.

| Guaranteed Whole | |

| Pros | Cons |

|---|---|

| A long-term policy that stays in effect as long as you pay the premiums | The policy is more expensive than conventional whole life policies |

| The policy has cash value | 2-3 year waiting period |

| No medical exam or questions about your health | Higher premiums |

| Automatic acceptance | |

| Guaranteed Term | |

| Pros | Cons |

| Guaranteed acceptance regardless of your health | The policy has an expiration date |

| Lower premiums than whole life | It may be more expensive when you renew your policy |

| 2-3 year waiting period before the face value is paid | |

Carriers & Typical Rates

You will find different rates for guaranteed issue whole life insurance from different carriers. Here are some examples of the monthly premiums you will pay from some carriers.

| Age | Coverage Amount | Insurer | Monthly Premium |

|---|---|---|---|

| 40 | $25,000.00 | Great Western | $119.58 |

| 45 | $25,000.00 | Great Western | $134.17 |

| 50 | $25,000.00 | Gerber | $108.86 |

| 55 | $25,000.00 | Gerber | $143.46 |

| 60 | $25,000.00 | Gerber | $158.36 |

| 65 | $10,000.00 | AIG | $84.15 |

| 70 | $10,000.00 | AIG | $98.18 |

Guaranteed Issue Life Insurance for Children

Some parents choose to buy guaranteed issue life insurance for their children to help them in the future. For instance, if a child has medical issues, and the parent fears they won’t be able to get life insurance as an adult, they may purchase a guaranteed issue life insurance policy for them and continue to pay the premiums throughout their life.

Another reason to buy life insurance for children is to secure the low rates for a child. Premiums for children are much lower than adult rates, and buying a 30-year policy will ensure those low rates for years to come.

Finally, if you purchase an insurance policy for your child, it will begin accruing cash benefits that will continue as your child grows.

FAQs: Guaranteed Issue Life Insurance

What is guaranteed issue life insurance?

Guaranteed issue life insurance policies offer guaranteed acceptance to all applicants. Even those in poor health who have been turned down for other types of coverage are eligible, because they don’t require a medical exam or any health questions to be answered. However, they have lower payouts and much higher premiums than policies where health information is collected during the application process. That’s why guaranteed life insurance is a last resort option that probably isn’t right for you if you can pass a medical exam.

Is burial insurance the same as guaranteed issue life insurance?

Some companies offer guaranteed issue burial insurance policies, which are a form of whole life insurance. Those who want a larger death benefit than what burial insurance provides can buy a different type of guaranteed whole life policy or a guaranteed term policy.

What coverage amounts do guaranteed life insurance policies come in?

Guaranteed life insurance policy amounts are low compared to some other types of plans. The coverage cap for death benefits is usually between $10,000 and $25,000, so people typically buy these policies to help their loved ones pay for specific debts, such as funeral expenses.

Do guaranteed life insurance premiums ever increase?

Your premiums may increase depending on the type of policy you buy. If you buy guaranteed whole life insurance, your premiums remain the same as long as you continue to pay them. Guaranteed term life insurance premium rates stay in effect for the length of your policy. If you want to buy another policy after it expires, your rates will rise because you’re older.

Can you have more than one guaranteed issue life insurance policy?

You can have as many life insurance policies as you need as long as you can afford the premiums.

Can I cash out my life insurance?

If you have a whole life insurance policy that has accumulated cash value, you can take a loan against it or surrender it for the full amount. Surrendering the policy means you will no longer be covered.

Will my life insurance payout if I have cancer?

If you have a guaranteed issue life insurance policy, it will pay out after the waiting period, no matter how you die. Because you won’t have to pass a medical exam or even disclose your medical condition, there are no disease restrictions as long as the waiting period has passed. If you pass during the waiting period, your beneficiary will receive a return of the premiums paid plus 10 to 20 percent.

Can life insurance companies refuse to pay?

Although you have guaranteed coverage with this type of policy, there are some instances where the insurer can deny a claim. For instance, some carriers won’t pay a claim if the deceased died of suicide. And if you die of natural causes before the waiting period is over, your loved ones won’t be paid the full face value of the policy.

Another reason for the non-payment of a claim is that no beneficiary was ever named. Finally, if you stop making payments on the policy, it will lapse and not be in-force anymore.

Next Steps

Some people consider guaranteed issue life insurance policies as the policies of last resort. For example, they are ideal for people who can’t get approved by conventional insurance agencies because of a diagnosis of a terminal disease.

But if you can pass a medical exam, or at least answer a few health questions, and you want to leave something behind to pay for your final expenses, burial insurance is a better choice. After all, funeral costs have skyrocketed in the past few years, and that’s why so many people purchase burial insurance. They prefer to take care of those expenses, so they’re loved ones aren’t burdened with the cost.