How to Pay for a Funeral: Your Complete Guide

But thinking ahead about how you’re going to pay for your funeral one day can be a smart investment. Chances are you aren’t quite sure how much it will cost, and you aren’t quite sure how it will be paid for.

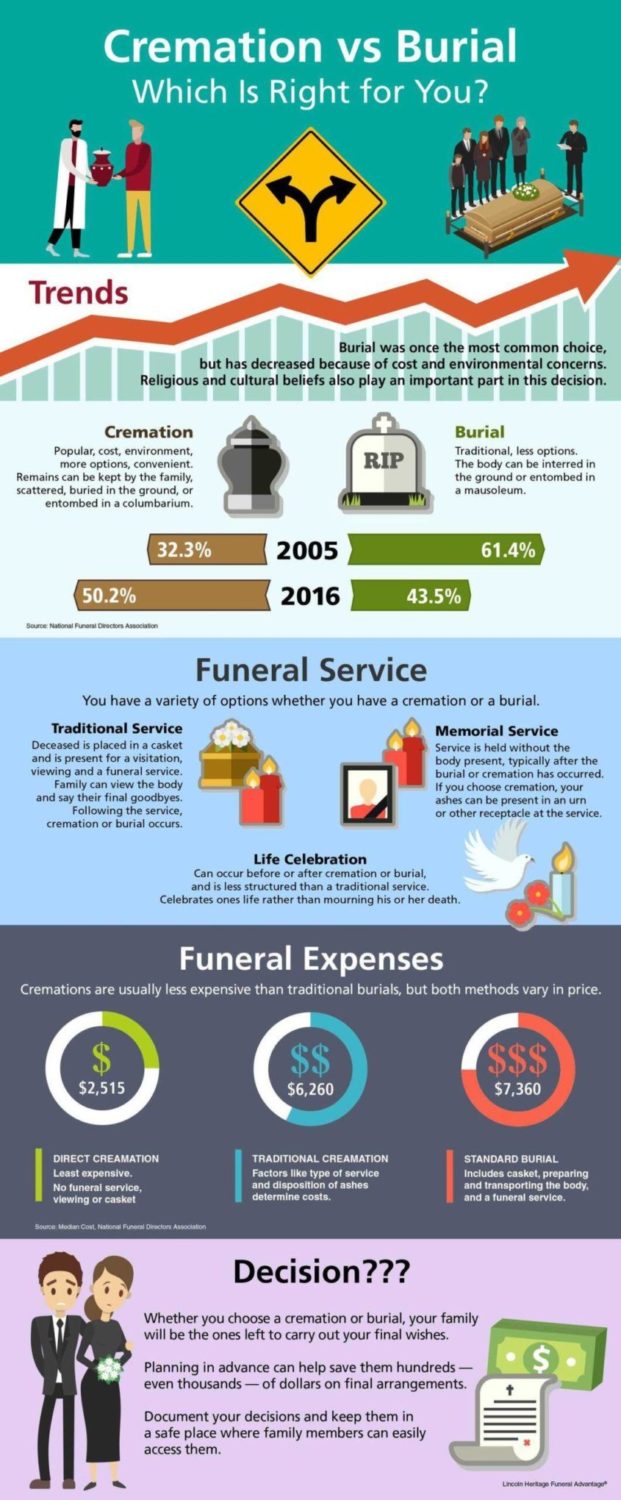

The average cost for a funeral has risen since the 1980s, and now costs between up to $9,000 or more depending on whether you choose cremation or a burial. That’s a lot of money for the average American household, and unfortunately, funerals put many people in debt. Luckily, you have options when it comes to getting help for a funeral.

Learn how to arrange to pay your funeral costs, so your loved ones don’t have to.

Table of Contents

How to Pay for a Funeral with No Money

When a loved one dies, it’s difficult enough. But if you’re struggling to pay for the funeral, it’s even worse. If you don’t have money to pay for a funeral, you should know that you still have options. Many charities and government institutions offer programs, and you can do some fundraising yourself. Also, you don’t have to pay for a fancy funeral. You can choose from several affordable options and save thousands.

Here are some of the ways to pay for a funeral with no money.

Research Affordable Plans

While it’s true the average funeral costs almost $9,000, you can often have a less expensive funeral if you know what your options are. Talk to your local funeral director about more affordable options, and don’t be afraid to call multiple funeral homes to compare rates and services. Here are a few funeral options to think about.

Cremation

There are two types of cremation: direct cremation and regular cremation. A direct cremation only costs a few thousand dollars or less depending on where you. The use of a funeral home is not included with direct cremation, so your loved one’s ashes are delivered directly to you, giving you the option of having a memorial service at a different location. With regular cremation, you can have a viewing beforehand and have full use of the funeral home and all of its services. Regular cremation can often cost thousands of dollars, so if you’re looking to save on cremation costs, consider having a direct cremation with a separate service.

Families often choose cremation when they can’t afford a traditional burial. Cremation also gives the family more flexibility with their loved one’s remains, allowing the ashes to be scattered at a location that was special to the deceased. It’s a great way to honor your loved one and celebrate their life.

Green Burial

Another great way to reduce funeral expenses is to ask for a green burial. These types of burials are becoming more popular as people become aware of environmental issues. In a green burial, funeral homes don’t use embalming fluid, and the cemetery sites don’t allow vaults. They only accept caskets that are biodegradable and non-toxic.

Some green cemeteries accept handmade wooden caskets, cardboard caskets, or even a special blanket or shroud instead of a casket. Check with your local green cemetery to see what options are available.

Home Funeral

In some cases, a private home burial may be the best option. When having a home funeral, make sure you follow all state and federal laws. Keep in mind that you may still incur costs for any memorial service you host, including costs for music, food, seating, etc.

Insurance Options

Another way to pay for final arrangements is to use life insurance. Depending on the type of policy you have, your beneficiaries can use the cash payout for your funeral expenses. When relying on life insurance to cover funeral expenses, it’s crucial you understand how quickly the benefits will be available. Some life insurance policies take weeks or months to pay, which would force you to pay for the funeral out-of-pocket. Other life insurance plans – like Lincoln Heritage Funeral Advantage® – pay approved claims in 24 hours, ensuring you have the money to pay the funeral home immediately.

Term Life Insurance

A term life insurance policy’s primary purpose is to replace a person’s income in the event of his or her death, especially when the family has children, a mortgage, and/or college and retirement. The beneficiary can also use it to pay for funeral expenses. Unlike whole life insurance, a term policy does not accrue any cash value. When the term expires, so does the death benefit. So, if you outlive your term life insurance policy, you must decide whether to purchase a new policy or go without insurance. Because term policies have large face amounts, the benefit may not paid immediately if the insurer has to review the claim. If you are relying on term insurance to cover funeral costs, you may have to pay the funeral home upfront and be reimbursed by the life insurance company at a later date.

Whole Life Insurance

Whole life insurance policies accrue cash value and offer cash payouts that beneficiaries can use to pay for funerals. In fact, one type of whole life insurance policy — called final expense insurance — is specifically dedicated to paying funeral costs. These policies usually cost less than typical life insurance policies and are specifically meant to cover the costs of funeral services and other end-of-life expenses. The policies usually pay a death benefit of $10,000-$25,000. Unlike pre-paid plans at funeral homes, final expense insurance has no restrictions on how beneficiaries can use the money. For instance, they can use the money for medical bills, final utility bills, or anything else.

Pre-Need Funeral Plans

In pre-need funeral plans, you plan for the funeral you desire with a specific funeral home and then pay for those arrangements ahead of time, either all at once or over time. The positive aspect of these plans is that your family doesn’t have to manage the decisions or expenses when you die.

The possible negative aspects are that over time, a funeral could end up costing more than you paid, and the family will have to make up the difference. Also, funeral homes may change ownership, be bought by a corporation, or go out of business. The safest route is to go with an independently owned, longtime funeral home with a local track record.

Employee Life Insurance

Many companies allow you to purchase life insurance at a substantially lower rate while you are working for them, or they include small policy as part of your benefits. Many people rely on their employee life insurance to cover their burial expenses, but if you leave that company or retire that benefit often goes away. Even if you plan on having your employer’s life insurance for many years, you’ll eventually have to take out a new policy – and at a much higher rate since your age will have changed. It’s often wise to take out a small final expense policy while you’re still in good health, even if you have coverage through your employer, so that you pay a cheaper rate in the future.

GET MY FREE BURIAL INSURANCE QUOTE

Pre-Paid Funeral Plans

In pre-paid funeral plans, you plan for the funeral you desire with a specific funeral home and then pay for those arrangements ahead of time, either all at once or over time. The positive aspect of these plans is that your family doesn’t have to manage the decisions or expenses when you die.

The possible negative aspects are that over time, it’s possible that over time your funeral could end up costing more than you initially paid, and your loved ones will have to make up the difference. Also, funeral homes may change ownership, be bought by a corporation, or go out of business. You could also decide to move and might not get a refund. Check with your local funeral home to see what pre-paid plans they offer and if there are any limitations to the plan.

Research Potential Options from Benefits

Another avenue to help reduce the burden of paying for a funeral when you don’t have the money is to look for allowable benefits. For example, if the deceased worked, the federal government pays a one-time lump sum to either the qualifying spouse or a qualifying surviving child of the person who has died.

If they were a veteran, the Veteran’s Administration may offer benefits as well.

If the deceased was part of a union, they might be entitled to benefits to help pay for the cost of the funeral. Also, your state and local government may offer programs to help pay for the cost of the funeral when you don’t have the money to pay for it. Start with your county administrator or coroner, who can usually provide you with information about any available benefits.

Research Options for Receiving Help

In cases where there is no insurance policy or other benefit available, families are responsible for covering the costs of the funeral. In addition to being a financial hardship, this means that grieving family members must make all of the funeral or memorial service arrangements on their own. During such an emotional time, it can be hard to separate what you can afford from how you felt about your loved one, even if you know that spending more does not mean you loved the person more.

Below are some options families often use when they have no other choice.

Fundraising Events

You can use fundraising events to raise money for a funeral. In some cases, families or friends sponsor fundraisers to help raise the money needed for a funeral. They may have musical acts performing for free and donated food and drink to maximize attendees’ donations.

If you want to raise funds online, you can use sites such as Go Fund Me, indiegogo, or Kickstarter. These are popular tools for those who need to raise money. By setting up a page on one of these websites and paying tribute to the person who has died, many families raise enough money to cover medical expenses in addition to funeral costs.

Funeral Loans

If you have no other way to pay for a funeral, a funeral loan might provide you with some relief. Because these loans are personal, you may not have to put up any collateral. But because you should expect to pay a high interest rate, and you’ll need a good credit score to qualify for one of these loans.

Churches

Some churches perform burials for reduced costs for those who can’t afford a funeral. Check with your church to find out if they offer any services or benefits for those who find themselves in this position.

What Happens if You Can't Pay for a Funeral?

In some instances, surviving loved ones have no way to pay for a funeral. The person who died may not have had insurance, so there is no cash benefit available that can be used for funeral expenses. This lack of funds only adds to the grief the family feels because they won’t be able to give their loved one the funeral they deserve. If the family is impoverished, the city of residence may provide a direct cremation for you. Speak with your local officials to determine whether or not this option is available in your area.

If your loved one’s body meets certain criteria, you can donate it to a university or private organization where it will be used for medical or educational research. Check that the organization has an American Association of Tissue Banks accreditation to ensure proper care and use. Donating a loved one’s body is a great way to give back to society, and in some cases the body will be cremated once the organization has finished using it. The remains are often given back to you to use as you wish.

Do I Pay My Pastor, Church, or Rabbi for a Funeral?

Although it’s not mandatory, it’s customary to give your pastor or rabbi a small fee, called an honorarium, when they perform a funeral service. The same holds true for any other member of the church who helps with the funeral, including the person who performs the music and those who helped you plan the memorial service.

How Much is Customary to Pay?

When paying an honorarium to a pastor or rabbi, the amount you pay depends on your preferences and budget. But most people pay between $150 and $300. Simply put the money in an envelope and give it to them after the service.

How to Pay for a Funeral With or Without Life Insurance

The process of paying for a funeral is very different depending on whether you have life insurance benefits available. Having cash on hand makes the process smoother and arrangements can be made faster. If funds aren’t available, final arrangements can still be made, but some service items may not be available.

With Life Insurance

If you have a life insurance policy, whomever you select as your beneficiary is usually the person who will make arrangements for your funeral. If the death benefit of your policy is issued quickly, your beneficiary can pay for your funeral costs up-front. If benefits aren’t available right away, your beneficiary can pay the funeral home out of pocket and wait for the insurance company to process the claim and distribute the funds at a later date.

In some cases you can make a funeral home your beneficiary, but it’s typically unwise to do this (especially if your death benefit is more than what your funeral will cost). For example, if you have a $10,000 policy and opt to have a direct cremation, there should be thousands of dollars left over for your family, but only if the funeral home doesn’t take advantage of its beneficiary status and use as much of the benefit as possible.

With life insurance, you can designate a specific amount or percentage of your benefit to be split among individuals or organizations. For example, you can specify that 50% of your benefit be paid to Person A, 30% to Person B, and 20% to charity.

Without Life Insurance

Paying for a funeral without life insurance is difficult, but not impossible. You will have to get creative, and you may not be able to afford the funeral you or the deceased imagined.

Here are two ways to pay for a funeral without insurance.

Savings Account – Opening a savings account is an easy way to pay for a funeral, but it requires discipline. You will have to consistently deposit money into the account, and not use it for other life expenses that come along. Remember that interest rates on a basic savings account are nearly nonexistent, so you can’t plan on the account to grow quickly.

But you can help reach your goal by adding extra money that you receive, such as bonuses from work or tax refund checks. Keep in mind that setting aside $25 - $50 a month for funeral expenses would take 16 years to cover the cost of a $10,000 funeral.

Payable on Death (POD) Account – Also called a Totten Trust, this option allows any person to set up a POD account at a bank, naming the beneficiary of his or her choice. While the account holder is alive, the account accrues interest, and the funds are available for withdrawal if desired.

It acts as a savings account, except when you die, it won’t have to go through probate. Instead, the beneficiary on the account can go directly to the bank and withdraw the funds. They can then use these funds to pay for your funeral.

As with a regular savings account, however, this method of paying for a funeral requires discipline to keep enough money in the account to pay funeral expenses if you die.

When a Veteran Dies, Who Pays for the Funeral?

If the deceased was a veteran, either active or retired, the surviving family members are entitled to a range of benefits. Keep in mind there are different guidelines on who is eligible for which benefits.

All military veterans are entitled to a free burial in a national cemetery and a grave marker. Spouses and dependent children of veterans are also entitled to a free plot and marker in a national cemetery.

For more information, you can visit the National Cemetery Administration, call the regional VA office in your area, or read our Funeral Planning Guide for Veterans.

Will the Military Pay for a Soldier's Funeral?

If a soldier dies during active duty, is discharged for any reason other than dishonorable, or served during wartime, the military will provide a free burial in one of the VA national cemeteries across the nation.

If you bury the soldier in a private cemetery, the military will provide a government marker or headstone, a burial flag, and a Presidential Memorial Certificate at no charge.

How Much Does the Federal Government Pay for a Funeral?

The federal government offers a one-time payout of $255 to every surviving spouse, or the child of a deceased person if there is no spouse, as long as the deceased was eligible. That’s not much money considering estimates of funeral costs range from $6,000 to $10,000 and above, according to the National Funeral Directors Association.

Other FAQs

When do you pay for a funeral?

Most funeral homes require that you make the payment upfront. That’s why beneficiaries who plan to use life insurance proceeds to pay for a funeral often assign the funeral home an assignment, which allows the insurance company to pay the funeral home directly.

Can you pay for a funeral with a credit card?

You can pay for a funeral with a credit card at most funeral homes, but keep in mind the high-interest rates most credit cards have. Funeral homes in some states are allowed to charge you a convenience fee when you pay with a credit card.

Do you have to pay for a funeral upfront?

All funeral homes have different rules, but most expect you to pay for a funeral upfront.

Can you pay for a funeral in installments?

Some funeral homes may make payment arrangements with you, depending on your financial situation. And if you arrange to pay your own funeral costs with a pre-paid funeral plan, you can usually set up an installment plan with the funeral home.

Will Medicaid help pay for a funeral?

Because funeral expenses are not considered medical expenses by Medicaid, they will not cover the cost of a funeral. But some states allow for exceptions. If you have a Medicare Advantage Plan, you can set aside money to cover your funeral expenses.

Learn More About Funeral Advantage

There’s growing interest in final expense life insurance – also called “burial insurance” or “funeral insurance” – because of its affordability and focus on helping with funeral costs. If you’re like most people, you don’t want to leave your loved ones with the high cost of funeral arrangements and other end-of-life expenses.

But not all final expense policies are the same. For example, most will provide a death benefit to your beneficiary, but that’s often the extent of their service. Most final expense insurance companies don’t help surviving loved ones price-shop funeral items or call local funeral homes for pricing information.

Just because your family has received the money to cover your funeral doesn’t mean they know where to start. Who should they call first? What documents do they need? What funeral home should they use?

That’s where Funeral Advantage can help. We’ve spent the last 50 years helping families just like yours navigate the ever-changing funeral industry. Last year alone, we saved policyholder families thousands of dollars on funeral costs. We take pride in giving your family more than just a check; we give them peace of mind because we’ll be there to help every step of the way.