Complete Guide to the Best Life Insurance for Seniors

Life insurance is one of the most trusted ways to provide for loved ones after you’ve passed. But deciding which policy is right for you can be challenging.

What kind of senior life insurance should you have? How much is enough? What’s the best life insurance to have at your age?

Life insurance for seniors is different from company to company, can involve taking a medical exam (also called a life insurance exam) or just answering health questions, costs anywhere from $15 a month to several thousand dollars a month, and can be used for everything from paying off large debts like a mortgage or covering small bills like funeral costs. So it takes some research to find the best life insurance for seniors. Although it’s true that you’ll pay more for life insurance once you’ve reached your golden years, that doesn’t mean you don’t have options. In fact, for those who want to leave cash benefits for their family — or those who want to ensure their final expenses are covered — affordable senior life insurance policies exist. You may be able to pay as little as $15 a month, or you could end up paying over $1,000 a month. In this article, we’ll cover all of your options – including final expense insurance for seniors – so you can make the right decision.

What is the Best Life Insurance for Seniors?

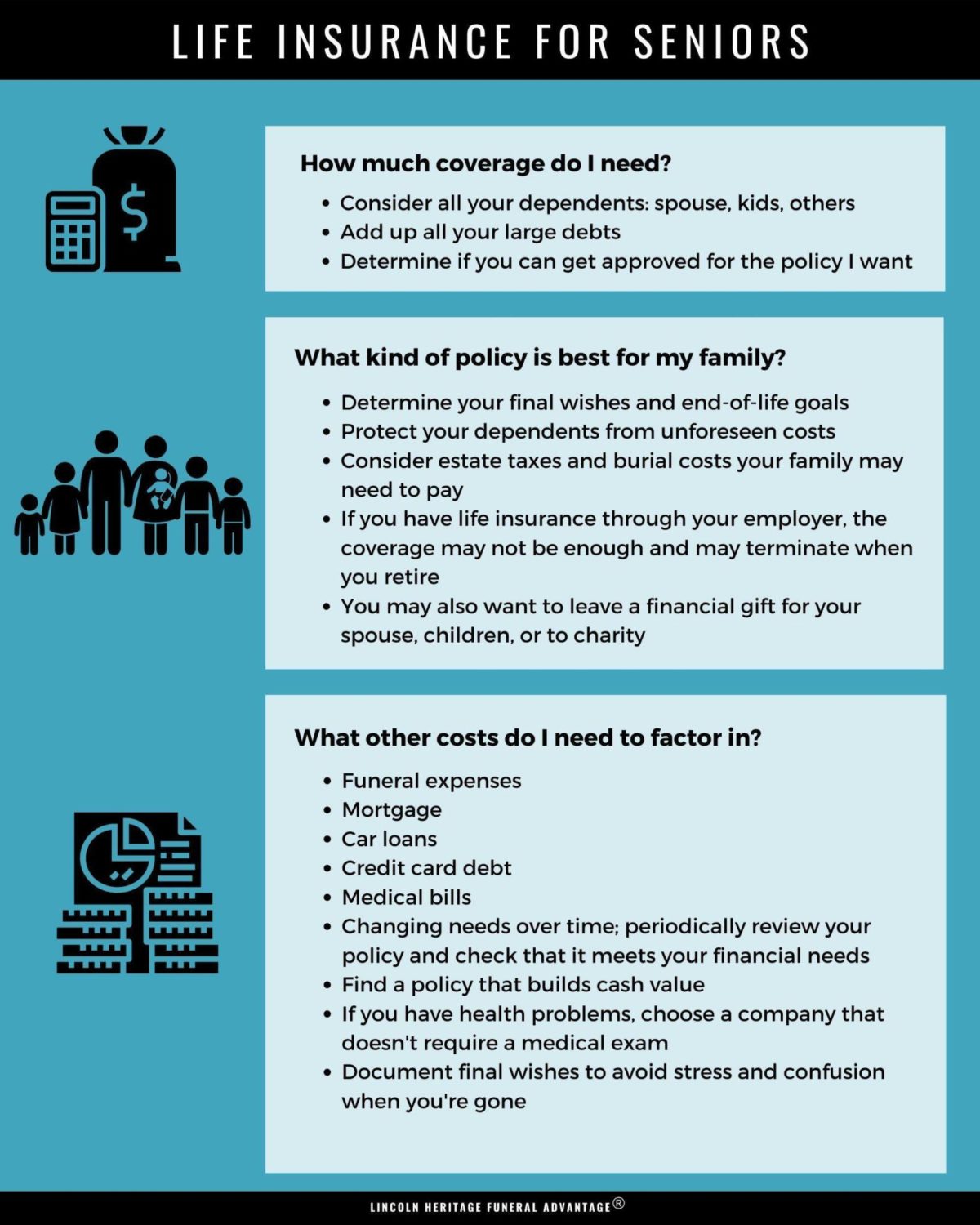

When looking for the best life insurance for seniors, it’s important to ask the following questions:

- How much coverage do I need?

- What kind of life insurance should I get?

- What kind of policy is best for my family?

- How much can I afford?

- Can I get approved for the policy I want?

You can start answering these questions by reviewing your financial situation. For example, do you have a spouse, kids, or anyone else who is dependent on you? Do you have large bills like a mortgage or car payment that would need to be paid when you’re gone? If anyone in your life depends on you financially, you should consider a policy to protect them from unforeseen costs. Even if you believe your dependents are adequately cared for, life insurance may still be worth considering because your family may need to pay estate taxes, end-of-life medical bills, and burial costs (which can cost $9,000 or more).

Determining how much coverage you need depends on a variety of personal factors, including your marital status, the size of your family, your debts, assets, and your end-of-life goals. As a rule of thumb, the Wall Street Journal recommends purchasing coverage equal to 8 to 10 times your annual income. If you have life insurance through your employer, the coverage may not be enough and may terminate when you retire.

Don’t forget to factor in other costs as well: funeral expenses, debt repayment (such as your mortgage, car loans, and credit card debt), and any medical bills associated with your passing. You may also want to leave a financial gift for your spouse, children, or to charity. Your needs will change as time goes by, so periodically review your policy and check that it meets your financial needs.

Here are some considerations for every major type of policy that will help you choose the best life insurance for seniors.

Whole Life vs. Term Life Insurance for Seniors

When thinking about whether you should buy term vs whole life insurance, you need to keep two things in mind: your age and your budget. Keep in mind that as you age, renewing a term life insurance policy will become more difficult which is why whole life insurance may be a smarter choice for seniors.

Term Life Insurance for Seniors

Term insurance pays benefits only if death occurs during the term of the policy, which normally is from one to 30 years. Most term policies do not offer any other additional benefits. Term policies usually come in two types: level-term (where benefits remain the same through the length of the policy), or decreasing-term (where benefits typically diminish over the life of the policy). Healthy men over 70 can expect to pay $122 to $435 for a ten-year term life insurance policy with a $200,000 death benefit. And healthy women will pay between $66 and $194 for the same policy.

Whole Life Insurance for Seniors

Whole life insurance, sometimes called permanent life insurance, pays benefits regardless of when the policyholder dies as long as the policy is still in force. Most whole life policies last for the life of the policyholder and some accumulate cash value that can distribute cash payouts in the form of a loan. Policy loans must be repaid while the policyholder is still alive or the loan amount will be deducted from the benefit at the time of death. For most traditional whole life policies, the death benefit and the insurance premium remain the same for the length of the policy.

When buying whole life insurance for seniors, healthy men should expect to pay between $1,122 and $2,089 a month for a $250,000 death benefit. And healthy women will pay $934 to $1,801 for their whole life insurance policies.

You can also choose to buy final expense life insurance for seniors, which is a type of whole life insurance. With it, you can usually avoid taking a medical exam and only have to answer a few health questions on the application. Premiums are significantly lower, too so people often consider it one of the best life insurance for seniors options. If you decide to purchase this type of plan, men will pay roughly $43 to $286 for a $10,000 policy, while women will pay about $33 to $211.

Guaranteed Universal Life Insurance for Seniors

Universal life or adjustable life allows for more freedom than a standard whole life policy. With some universal policies, you can reduce or even skip payments although this may cause the value of the policy to increase at a slower rate since you are covering your payments with the current cash value.

If you have health conditions that make it hard to qualify for term insurance, guaranteed universal life insurance is something to consider since it’s a cross between term life insurance and whole life insurance. You will need to undergo an underwriting process just as you would when buying a term life insurance policy for seniors.

Final Expense Insurance for Seniors

Final expense insurance – also called “burial insurance” or “funeral insurance” – is a type of whole life insurance meant to help your loved ones with funeral costs and other end-of-life expenses like unpaid medical bills. Today, funerals more than $9,000 according to the National Funeral Directors Association. Final expense policies are popular with seniors because you often don’t have to take a medical exam to qualify – coverage is issued based on answers to health questions on the application. Policy rates are typically more affordable than other types of life insurance because the policy amount is usually much smaller, typically $10,000 – $15,000.

Affordable Life Insurance for Seniors

In general, final expense insurance is typically the most affordable because you can buy a policy for as little as $15 a month. Final expense plans are perfect for seniors on a fixed income or for those who may have trouble qualifying for larger policies.

When deciding how much senior life insurance you can afford, be sure to consider your entire budget and any future changes that may impact your finances. Some may look for the cheapest life insurance available, but many times these policies aren’t meant for seniors. Choose a policy with the benefits most likely to help surviving loved ones.

The cost of your policy will depend on your sex, age, overall health, and the coverage amount you’re taking out. If your goal is to ensure you don’t leave behind your funeral costs for your loved ones, you only need a final expense insurance policy. But if you want to leave something more to your beneficiary, a term or whole life plan may be better if you can afford it.

No Medical Exam Life Insurance for Seniors

Some people feel that because of their age or health they will not be approved for senior life insurance. But enhancements in insurance underwriting and the availability of specialty insurers who focus on covering those with higher risks means life insurance is available to almost everyone.

Once you’ve found a company and policy that meets your needs, you will be asked to fill out an application. To be approved for coverage, you’ll need to provide some personal information about yourself, such as your age, your height and weight, any health conditions you have, and any life insurance you already have. For some insurers, you may be asked to complete a medical exam to qualify.

For smaller policies, some companies offer life insurance without a medical exam. Final expense insurance for seniors is usually issued based on answers to health questions on the application. It’s important to answer all questions honestly when filling out your application so your coverage can be issued accurately. Misrepresenting the truth can result in your policy being canceled or death benefits being denied if incorrect information was provided.

Guaranteed issue life insurance (also known as guaranteed life insurance) plans also exist, but these are often very expensive and may not fit most budgets.

Senior Life Insurance Sample Rates

Over 60

Searching for life insurance for seniors over 60 is a much different process than for those in their 50s. Once you reach age 60, things in your life begin to change, and that can affect how you look at life insurance. You may stop working, your health could begin to deteriorate, your living expenses may decrease, or you could begin work on a plan to pass your business to your heirs. All of these life changes may make you question your current life insurance policy.

For example, if you currently have term life insurance, which is good for only a specified period, you may decide to switch to a universal life insurance policy. With this type of policy, you can lower your death benefit as the policy ages and your circumstances change. If you initially bought the policy to cover, say, your mortgage after your death, you can lower the death benefit as your mortgage decreases.

You will also earn interest on the accumulating cash value of the policy. And the IRS won’t take a share of your earnings because the taxes on a universal life insurance policy’s cash value are deferred. And if you leave the cash value to a beneficiary, they may not have to pay income taxes on it, either.

If you’re a man over 60, you can expect to pay about $627 for a universal life insurance policy with a death benefit of $250,000. And if you’re a woman over 60, you will pay about $546 for the same policy.

Over 65

People are working longer these days than they used to, and if you’re over 65 and working, that means you probably have people who rely on your income. It may be your spouse, or you may take care of a sibling or other relative whose health is failing. Also, people who are 65 and over typically have some sort of debt, and a life insurance policy can help ensure that you won’t leave it for your loved ones to pay.

When deciding which type of insurance is better at this age, you need to look at your life situation and your goals. If you have a strict budget, but your goal is to make sure your loved ones aren’t saddled with your debts when you die, term life insurance may be right for you.

You can use a term life insurance policy for a period of time for a specific goal. For instance, if you have three years left of car payments, you can take out term life insurance for three years. That way, if you pass before making your final payment, your beneficiaries can use the life insurance policy to pay off the car.

On the other hand, if you don’t have debt but want to leave some cash for your loved ones, permanent or whole life insurance may be a better option.

You will experience several benefits with a whole life insurance policy. Unlike term insurance, whole life insurance covers you for your whole life as long as premiums are paid. You don’t have to re-qualify at any time. That’s an important benefit for seniors because the older you get, the more difficult and expensive it becomes to get a new policy (especially as your health changes).

An example of a whole life insurance policy is final expense insurance. This type of policy has lower payouts designed to pay for your funeral expenses as well as other end-of-life expenses such as your outstanding utility bills, medical bills, and other debt. Final expense policies build cash value, which can be loaned to the policyholder if they need it. The payouts for final expense insurance are lower — and so are the premiums.

The price differences between a term life insurance policy and a whole life insurance policy are stark. For example, a healthy 65-year-old man will pay about $110 for a ten-year $250,000 term policy, while a whole life insurance policy with the same death benefit would cost approximately $1,122.84 a month. And a woman’s policy for the same death benefit runs about $934.82 a month. Because final expense plans have such a low face amount (usually in the $10,000 range) the monthly premiums are much more affordable, typically in the $50 a month range.

Over 70

It’s also a different experience buying life insurance for seniors over 70. People who are over the age of 70 probably don’t have a lot of debt but may still want to take care of their loved ones. At this stage of life, whole life insurance is very expensive, which is why many 70-year-olds and older purchase final expense insurance. Term insurance companies won’t offer 70-year-olds 30-year policies, but you can probably find a ten-year policy. Alternatively, final expense insurance is available to you, and the rates are much more affordable.

For example, once you reach 70, you can expect to pay much more for term life insurance. For a ten-year term life insurance policy with a $250,000 death benefit, a healthy man with no health conditions or medications will pay about $195 a month. And a woman will pay $148 monthly for the same policy. On the other hand, final expense insurance with a $10,000 death benefit will cost roughly $81 a month, and a woman can purchase the same policy for just $61.

Over 75

Although you can still find insurance for people over 75, your options are fewer — and more expensive. But it’s always a good idea to have life insurance, no matter your age. It will enable you to leave something behind to your loved ones and make sure they aren’t stuck with your outstanding medical bills, income taxes, utility payments, and burial expenses.

You can still find whole life insurance for over 75, but to get a policy, you need to be healthy. If you have diabetes or other chronic illnesses, the underwriters may not approve the policy. The good news is that, if you are healthy and can get a policy, it will stay in effect until you pass. And that means you will never have to apply for insurance again. A healthy man over 75 can find a whole life insurance policy for about $2,000 a month and a woman will pay about $1,800 per month.

But if you’re not healthy, you should look at two other types of insurance over 75.

The first is guaranteed universal life insurance. This is also known as “term for life” or “term to 110” insurance. It acts like a whole life insurance policy except it doesn’t build cash value. With this type of policy, you get to select the maximum age. Most policies extend to age 121. You can qualify for a guaranteed universal life insurance policy even if you have medical conditions or a pre-existing condition. Your premium will depend on your health conditions, but a man can expect to pay $300 to $400, and a woman will pay $250 to $325.

A more affordable option is final expense insurance, a no-medical exam life insurance policy where coverage is issued based on answers to health questions on the application. Healthy men age 75 and older will pay about $123 a month for a $10,000 policy and women will pay approximately $101.

Over 80

Purchasing life insurance for seniors over 80 can be challenging. Because the maximum age for term life insurance is 89, people who want insurance over 80 should consider buying whole life insurance. But to qualify for a typical policy, you need to be healthy and take a medical exam. But since most policies don’t break even for seven to ten years, they may not be your best option.

A great alternative for insurance over 80 is final expense insurance. If you don’t have major debts and want to ensure you leave enough for your burial expenses, this type of policy might be right for you. Men over 80 can expect to pay about $183 for final expense insurance, and women over 80 will pay about $145.

Over 85

Buying life insurance over 85 becomes a bit more complicated but not impossible. It’s still advisable that you buy life insurance for a few reasons. At 85, your children may be assisting with your care, and it makes sense to leave them something to help pay for your final expenses.

You can also choose to buy a no medical-exam insurance policy like final expense insurance. These types of policies have lower death payouts, and that makes them more affordable. Your beneficiaries can use the money to pay for your funeral or any outstanding debts you leave behind. Coverage is issued based on answers to health questions on the application.

Men over 85 can get a $10,000 final expense plan for $183 to $286, and women can buy the policy for approximately $136 to $211.

Over 90

Once you reach 90, most insurance companies won’t issue you a life insurance policy. You may be able to find a life insurance company who will insure you, but be prepared to pay a very high premium.

Senior Life Insurance FAQs

Getting the best life insurance for seniors can be hard because of the numerous options available, but there are a few facts you should know to help you make the right decision. Here are a few FAQs to consider when searching out the right policy for you and your loved ones.

When Does the Policy Kick In?

Different insurance companies have different guidelines that dictate when your policy will go into effect. For instance, some life insurance policies are effective immediately; others won’t pay the death benefit if you die in the first two years of your policy. Be sure to ask your insurance company about this important question before buying a policy.

What If I Have a Medical Condition?

Even with a medical condition, most can still qualify for life insurance. The life insurance company will look at your unique circumstances, review your overall health, and let you know whether or not you qualify. In some cases, you will be issued a modified plan with higher premiums.

What Happens if I Die After my Term Life Insurance Policy Ends?

Unfortunately, a term life insurance policy is only good for the term it covers. So, if you purchase a 10-year term life insurance policy and die three months after the term ends, your beneficiaries won’t get the death benefit. When your term ends, you have to renew the policy to remain covered. Term policies aren’t usually the best life insurance for seniors.

What if I Waited Too Long to Get Life Insurance?

It’s true that getting a good life insurance policy gets more difficult as you age, but you can get certain types of life insurance well into your 80s.

Life Insurance Quotes for Seniors

If you’re concerned about finding an affordable life insurance policy that’s easy to qualify for, consider getting a policy from Lincoln Heritage Life Insurance Company®. We are the leading final expense insurance company in the country and can qualify most people, even those with health problems. We’ve been serving seniors and their families since 1963. Best of all, our policies don’t require a medical exam – just answer health questions on our 1-page application. We’ll work with you to find the best life insurance for seniors with your unique needs and within your budget.